Soal

- Jelaskan secara singkat apa yang anda ketahui tentang UDP

- Jelaskan perbedaan TCP dan UDP

- Berikan contoh aplikasi –aplikasi yang menggunakan protokol UDP, dan jelaskan bagaimana kerja aplikasi tersebut.

- Bagaimana konsep Client Server dalam jaringan komputer

- Jelaskan secara singkat apa yang anda ketahui tentang Protokol Transport.

- Dalam protokol transport terdapat dua protokol utama yaitu TCP and UDP, jelaskan perbedaan TCP dan UDP.

- Berikan contoh aplikasi –aplikasi yang menggunakan protokol TCP, dan jelaskan bagaimana kerja aplikasi tersebut.

- Jelaskan langkah dan prinsip kerja socket programming untuk komunikasi dua arah

Jawab

1. UDP (User Datagram Protocol) adalah

protokol pada layer transport yang bersifat conectionless. Artinya UDP

tidak mementingkan bagaimana keadaan koneksi, jadi jika terjadi

pengiriman data maka tidak dijamin sampai tidaknya. Pada UDP juga tidak

ada pemecahan data, oleh karena itu tidak dapat dilakukan pengiriman

data dengan ukuran yang besar.

UDP memiliki empat header antara lain:

-Source Port/socket sumber

-Destination Port/ socket tujuan

-Length

-Checksum

2. Perbedaan TCP dan UDP

Berbeda dengan TCP, UDP merupakan connectionless dan tidak ada

keandalan, windowing, serta fungsi untuk memastikan data diterima dengan

benar. Namun, UDP juga menyediakan fungsi yang sama dengan TCP, seperti

transfer data dan multiplexing, tetapi ia melakukannya dengan byte

tambahan yang lebih sedikit dalam header UDP.

UDP melakukan multiplexing UDP menggunakan cara yang sama seperti

TCP. Satu-satunya perbedaan adalah transport protocol yang digunakan,

yaitu UDP. Suatu aplikasi dapat membuka nomor port yang sama pada satu

host, tetapi satu menggunakan TCP dan yang satu lagi menggunakan UDP—hal

ini tidak biasa, tetapi diperbolehkan. Jika suatu layanan mendukung TCP

dan UDP, ia menggunakan nilai yang sama untuk nomor port TCP dan UDP.

UDP mempunyai keuntungan dibandingkan TCP dengan tidak menggunakan

field sequence dan acknowledgement. Keuntungan UDP yang paling jelas

dari TCP adalah byte tambahan yang lebih sedikit. Di samping itu, UDP

tidak perlu menunggu penerimaan atau menyimpan data dalam memory sampai

data tersebut diterima. Ini berarti, aplikasi UDP tidak diperlambat oleh

proses penerimaan dan memory dapat dibebaskan lebih cepat. Pada tabel,

Anda dapat melihat fungsi yang dilakukan (atau tidak dilakukan) oleh UDP

atau TCP.

3. Contoh protokol aplikasi yang menggunakan UDP :

1. DNS (Domain Name System) 53

Cara Kerja DNS (Domain Name System)

DNS menggunakan relasi client – server untuk resolusi nama. Pada

saat client mencari satu host, maka ia akan mengirimkan query ke server

DNS. Query adalah satu permintaan untuk resolusi nama yang dikirimkan ke

server DNS.

a. Pada komputer Client, sebuah program aplikasi misalnya

http, meminta pemetaan IP Address (forward lookup query). Sebuah program

aplikasi pada host yang mengakses domain system disebut sebagai

resolver, resolver menghubungi DNS server, yang biasa disebut name

server.

b. Name server meng-cek ke local database, jika ditemukan,

name server mengembalikan IP Address ke resolver jika tidak ditemukan

akan meneruskan query tersebut ke name server root server.

c. Terakhir barulah si client bisa secara langsung

menghubungi sebuah website / server yang diminta dengan menggunakan IP

Address yang diberikan oleh DNS server.

Secara sederhana cara kerja DNS bisa dilihat pada gambar berikut ini:

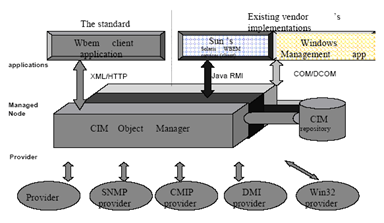

2. SNMP, (Simple Network Management Protocol) 161, 162

Cara Kerja SNMP

Ketika jaringan komputer besar dan aktifitasnya juga besar, maka

sangat diperlukan suatu manajemen jaringan. Untuk itu diperlukan SNMP

(Simple Network Management Protocol), yaitu sebuah protokol standar yang

didesain untuk membantu administrator dalam memonitor dan mengatur

jaringan komputernya secara sistematis dari dalam satu kontrol saja.

3.. TFTP (Trivial File Transfer Protocol) 69

Cara Kerja TFTP:

File-transfer-protocol menggunakan TCP untuk mendapatkan

komunikasi dalam jaringan yang dapat diandalkan. Jika jaringan sudah

cukup dapat diandalkan, seperti umumnya pada jaringan LAN maka dapat

dipergunakan file-transfer-protocol yang lebih sederhana, yaitu dapat digunakan user-datagram-protocol(UDP) untuk mendasari protocol transport (host-to-host). Sebagai contoh file-transfer-protocol yang menggunakan UDP adalah trivial-file-transfer-protocol (TFTP).

4. SunRPC port 111.

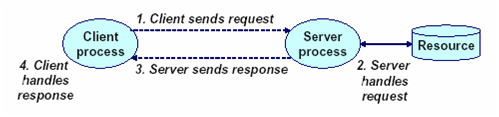

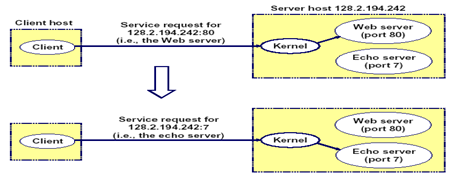

4. Konsep Client Server Pada Jaringan Komputer

Sesuai dengan namanya, Client-Server berarti adanya pembagian kerja

pengolahan data antara client dan server . Saat ini, sebagian besar

jaringan menggunakan model client/server.

Secara singkat, jaringan client/server adalah jaringan dimana komputer client bertugas melakukan permintaan data dan server bertugas melayani permintaan tersebut.

Secara singkat, jaringan client/server adalah jaringan dimana komputer client bertugas melakukan permintaan data dan server bertugas melayani permintaan tersebut.

Komputer client menerima instruksi dari user melalui interface yang

disediakan, merubah format instruksi ke bentuk yang dapat dimengerti

oleh database server, dan mengirimkannya melalui jaringan ke server yang

dituju. Server kemudian akan mengolah request, memilih informasi yang

sesuai, dan mengirimkan kembali data hasil pengolahan ke client. Client

kemudia mengolah data yang diterima untuk ditampilkan sebagai informasi

yang berguna melalui interface yang tersedia.

Transaksi Client-Server

5. Layanan transport pada Internet :

a. reliable, pengiriman dalam suatu urutan dengan model unicast. Contoh : TCP

b. unreliable, pengiriman tidak dalam suatu urutan dengan model unicast atau multicast. Contoh : UDP

Pada layanan transport, satuan data yang dipertukarkan disebut

sebagai segment (TPDU yaitu Transprot Protocol Data Unit). Layanan

transport menyediakan demultiplexing untuk dapat mengirimkan segment ke

proses lapisan aplikasi yang sesuai berdasar alamat dan port proses

tersebut. Selain itu juga melakukan multiplexing, yang akan mengambil

data dari beberapa proses aplikasi, dan membungkus data dengan header.

Multiplexing dan Demultiplexing di dasarkan pada pengirim dan nomor port

serta alamat IP penerima. Terdapat nomor port sumber dan tujuan pada

tiap segment. Protokol transport digunakan untuk menyediakan komunikasi

logika antar proses aplikasi yang berjalan pada host yang berbeda

protokol transport berjalan pada end systems.

6. Protokol TCP

TCP (Transmision Control Protocol) adalah protokol pada layer

transport yang bersifat conection oriented, berfungsi untuk mengubah

satu blok data yang besar menjadi segmen-segmen yang dinomori dan

disusun secara berurutan. Proses pembuatan koneksi TCP disebut juga

dengan proses “Three-way Handshake“. Tujuan metode ini

adalah agar dapat melakukan sinkronisasi terhadap nomor urut dan nomor

acknowledgement yang dikirimkan oleh kedua pihak (pengirim dan

penerima). Prosesnya antara lain:

- Host pertama (yang ingin membuat koneksi) akan mengirimkan sebuah segmen TCP dengan flag SYN diaktifkan kepada host kedua (yang hendak diajak untuk berkomunikasi).

- Host kedua akan meresponsnya dengan mengirimkan segmen dengan acknowledgment dan juga SYN kepada host pertama.

- Host pertama selanjutnya akan mulai saling bertukar data dengan host kedua.

TCP menggunakan proses Handshake yang sama untuk mengakhiri koneksi

yang dibuat, namun menggunakan flag FIN bukan SYN. Hal ini menjamin dua

host yang sedang terkoneksi tersebut telah menyelesaikan proses

transmisi data dan semua data yang ditransmisikan telah diterima dengan

baik. Itulah sebabnya, mengapa TCP disebut dengan koneksi yang reliable.

Protokol UDP:

UDP ( User Datagram Protocol) adalah jenis transfer data yang lain

dari TCP. UDP mempunyai karateristik connectionless (tidak berbasis

koneksi). Dengan kata lain, data yang dikirimkan dalam bentuk packet

tidak harus melakukan call setup seperti pada TCP. Selain itu, data

dalam protokol UDP akan dikirimkan sebagai datagram tanpa adanya nomor

identifier. Sehingga sangat besar sekali kemungkinan data sampai tidak

berurutan dan sangat mungkin hilang/rusak dalam perjalananan dari host

asal ke host tujuan. Tergantung pada host penerima/tujuan, apakah akan

meminta kembali pakcet yang rusak atau hilang. Kelebihan UDP adalah pada

saat digunakan pada lightweight protokol, misalnya saja DNS(Domain Name

Service). Selain itu protokol UDP lebih fleksibel karena misalnya saja

terjadi kemacetan pada salah satu bagian jaringan, maka datagram dapat

dialihkan menghindari bagian yang mengalami kemacetan tersebut. Kemudian

apabila sebuah simpul(node) mengalami kerusakan/kegagalan, maka pacekt

packet berikutnya dapat menemukan jalan/rute pengganti yang melewati

simpul tersebut.

7. Contoh protokol aplikasi yang menggunakan TCP

a. TELNET, terminal interaktif untuk mengakses suatu remote pada internet.

Cara kerja TELNET :

Protokol TELNET dipakai untuk menyamai seperti terminal yang terkoneksi untukhost secara

remote (berjauhan). Prinsip kerjanya menggunakan TCP sebagai protokol

transport untuk mengirimkan informasi dari keyboard pada user menujuremote-host serta menampilkan informasi dari remote-hostke workstation pada user. Untuk menjalankan proses TELNET maka digunakan komponen TELNET untukclient yang dijalankan pada workstation(user) dan server TELNET yang dijalankan pada host.

b. FTP (File Transfer Protocol), transfer file berkecepatan tinggi antar disk.

Cara Kerja FTP:

FTP menggunakan protokol transport TCP untuk mengirimkan

file. TCP dipakai sebagai protokol transport karena protokol ini

memberikan garansi pengiriman dengan FTP yang dapat memungkinkan user

mengakses file dan directory secara interaktif, diantaranya:

a. Melihat daftar file pada direktory remote dan lokal.

b.Menganti nama dan menghapus file

c. Transfer file dari host remote ke lokal (download)

d. Transfer file dari host lokal ke remote (upload)

c. SMTP (Simple Mail Transfer Protocol), sistem bersurat di internet

Cara Kerja SMTP:

SMTP mampu menangani pesan berupa teks kode ASCII yang akan dikirimkan kedalam kotak surat (mail-boxes) pada host TCP/IP yang telah ditentukan untuk melayani e-mail. Mekanisme SMTP: dimana user yang ingin mengirimkan e-mail berinteraksi denganmail-system lokal lewat komponen user agent (UA) pada mail-system. E-mail yang akan dikirim terlebih dahulu disimpan sementara dalam outgoing-mail-box, selanjutnya SMTP pengirim memproses e-mail pada yang dikumpulkan padaoutgoing-mail-box secara periodik. Jika pengirim SMTP menemukan e-mail padaoutging-mail-box, maka secara langsung akan membuat koneksi TCP dengan hostyang dituju untuk mengirimkan e-mail. Penerima SMTP dalam proses sebagai tujuan yang harus meneima koneksi TCP, selanjutnya e-mail dikirim pada koneksi ini. Pada penerima SMTP ini e-mail disimpan dalam host tujuan pada masing-masing mail-box sesuai dengan alamat tujuan. Jika mail-box dengan nama yang tidak sesuai dengan nama mail-box yang ada pada host tujuan, maka emaildikirim kembali yang menunjukkan mail-box tidak ada.

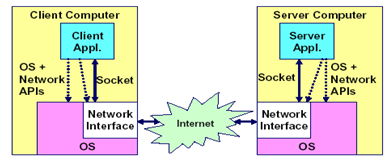

8. Prinsip Kerja Socket Programming

a. Antarmuka (interface) antara program aplikasi dengan

protokol komunikasi pada suatu sistem operasi disebut Application

Program Interface (API). API didefinisikan sebagai suatu kumpulan

instruksi yang mendukung proses interaksi antara suatu perangkat lunak

dengan suatu protokol yang digunakan.

b. Pada mesin keluarga Linux, socket terintegrasi dengan I/O

sehingga aplikasi yang berkomunikasi dengan socket, cara kerjanya sama

dengan suatu aplikasi yang mengakses peralatan I/O. Oleh karena itu

untuk memahami cara kerja socket pada Linux, sebelumnya harus juga

memahami fasilitas I/O pada Linux.

c. Pada saat suatu aplikasi berkomunikasi, awalnya aplikasi

membuat socket baru, maka pada aplikasi tersebut akan diberikan nomer

yang digunakan sebagai referensi socket. Jika ada suatu sistem yang

menggunakan nomer referensi socket tersebut, maka akan terjalin suatu

jaringan komunikasi antar komputer sebaik transfer data lokal.

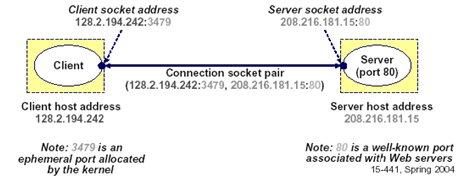

d. Untuk berkomunikasi dengan server, client harus tahu nomor

IP server begitu juga server, nomor port yang dituju, nomor port

menunjukkan service yang dijalankan. Contoh port23 untuk Telnet Server,

port 25 untuk Mail Server dan port 80 untuk Web Server. Dalam hal ini

aplikasi di client sudah mengetahui port yang akan dituju. Contoh

program aplikasi di client yang meminta service di server ada;ah ftp,

telnet, ssh. Untuk melihat service bisa dilihat pada file /etc/services.

e. Program yang berjalan di server, akan berjalan sepanjang

waktu (disebut sebagai daemon) sampai mesin/service dimatikan, menunggu

request dari client sesuai service yang diminta.

EmoticonEmoticon